Topps to return to NASDAQ as publicly traded company

This entry was posted on April 6, 2021.

Warning: ini_set() has been disabled for security reasons in /home/blowtest/public_html/app/code/community/Fishpig/Wordpress/Addon/PluginShortcodeWidget/Helper/Core.php(1) : eval()'d code on line 268

Warning: ini_set() has been disabled for security reasons in /home/blowtest/public_html/app/code/community/Fishpig/Wordpress/Addon/PluginShortcodeWidget/Helper/Core.php(1) : eval()'d code on line 268

Warning: ini_set() has been disabled for security reasons in /home/blowtest/public_html/app/code/community/Fishpig/Wordpress/Addon/PluginShortcodeWidget/Helper/Core.php(1) : eval()'d code on line 268

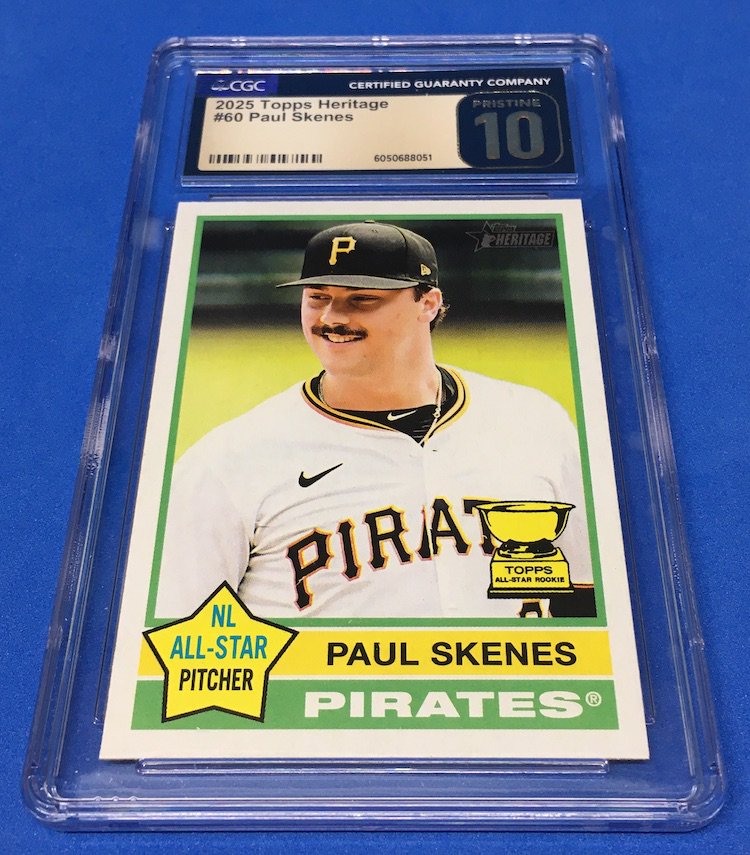

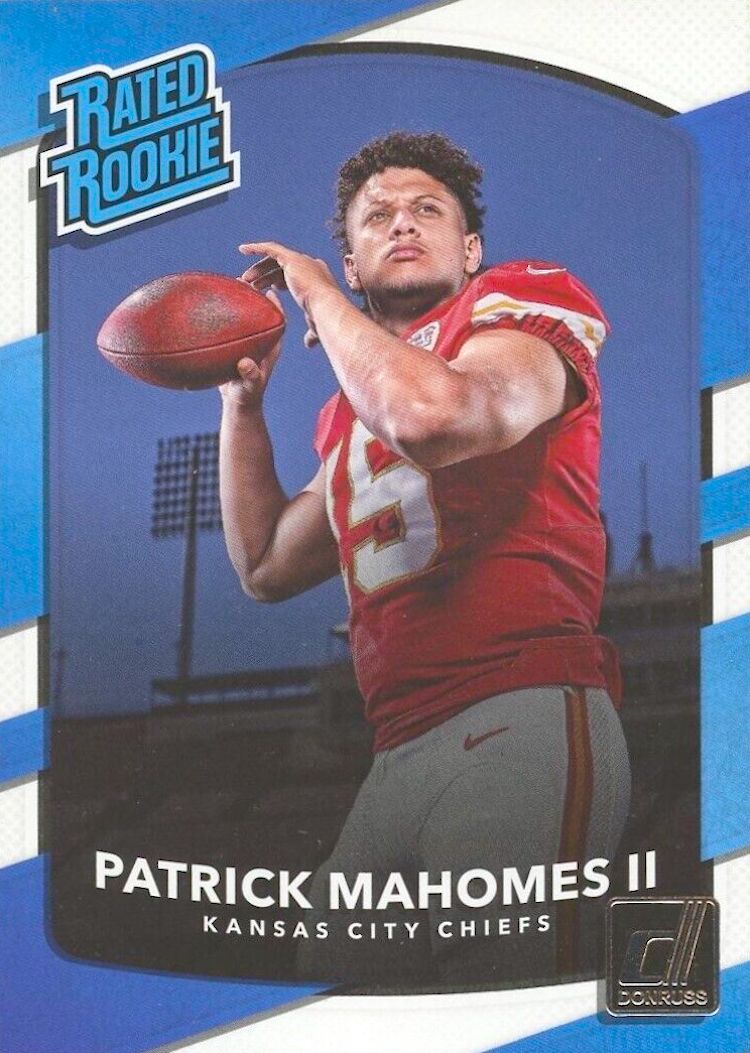

You will soon have another way to trade Topps.

After a record-setting $567 million in sales in 2020 -- a 23-percent increase over the previous year -- the company is going public after a merger with Mudrick Capital Acquisition. The $1.3 billion company will be traded as TOPP on NASDAQ once the deal closes later this year.

The company has been publicly traded before. On Oct. 12, 2007, it was purchased by Michael Eisner's The Tornante Company LLC and Madison Dearborn Partners LLC with shareholders receiving $9.75 per share (approximately $3.85 million.) Eisner, the former chairman and CEO of Disney before chairing Topps, will become chairman of the combined company’s board of directors.

“The strong emotional connection between the Topps brand and consumers of all ages is truly foundational, and, when combined with our growing portfolio of strategic licensing partnerships, creates a profitable business model with meaningful competitive advantages," Eisner said in a prepared release. "Equally important, the management team at the helm of Topps, which we’ve been building for the last 14 years, is outstanding, with deep roots in sports and entertainment, digital, gift cards and confections.

"Through this transformation, Topps has enjoyed a strong partnership with Madison Dearborn Partners. With the support of our new partners at Mudrick Capital, the company will continue its long history of innovation and global expansion, bringing consumers the best of collectibles and confections products while successfully extending into new verticals and emerging categories to take advantage of digital content innovation and high=growth opportunities across the globe. That is why I’m not selling a single share of Topps stock in this transaction."

Joining the board will be Jill Ellis, the coach of the U.S. Women’s 2013 and 2019 FIFA World Cup-winning soccer teams, as well as Maria Seferian of Hillspire LLC, Marc Lasry the co-owner of the Milwaukee Bucks and co-founder of Avenue Capital Group, and Andy Redman, the president of The Tornante Company. Topps will continue to be led by Michael Brandstaedter its current President and CEO.

“Topps is an 80-year-old company with decades of rich tradition and history, but very much built for the 21st century," Brandstaedter said. "We partner with some of the world’s most-iconic brands, and we are in the business of creating powerful consumer connections every day. The strategies we have implemented in recent years, including building a digital business that has deepened consumer engagement, have driven excitement and innovation across Topps, fueling strong and increasing revenue with accelerating profitability. The future for Topps has never been brighter, and, with a talented and dedicated management and employee base, we are excited for the road ahead."

According to the release, the deal "implies a pro forma enterprise value for The Topps Company of approximately $1.3 billion, or 12.5x 2021 projected adjusted EBITDA with estimated net debt of less than $150 million."

--

Follow Buzz on Twitter @BlowoutBuzz or send email to BlowoutBuzz@blowoutcards.com.

Warning: ini_set() has been disabled for security reasons in /home/blowtest/public_html/app/code/community/Fishpig/Wordpress/Addon/PluginShortcodeWidget/Helper/Core.php(1) : eval()'d code on line 268

Warning: ini_set() has been disabled for security reasons in /home/blowtest/public_html/app/code/community/Fishpig/Wordpress/Addon/PluginShortcodeWidget/Helper/Core.php(1) : eval()'d code on line 268